SUMMARY OF RESULTS

During the year 2019, MRG has improved its financial results, consolidating a continued positive and stable evolution of the company.

The improvement is due to an increase in the regulated remuneration caused by a greater demand and by reducing the costs, as a result of investments made in previous years. In addition, there has been a drop in financial expenses regarding 2018 due to having less gross debt by having already amortised the 500 million Euros bond that was re-financed in 2017.

The energy transported by our distribution network was 10.1 TWh and consolidates a growth trend, because it represents greater energy than previous years excepting the high peak in 2018, which was a cold year.

The company’s growth strategy continues to be profitable and sustainable expansion in our territory and in adjacent territories. At the close of 2019, Madrileña Red de Gas distributes gas to 908,000 supply points, of which 885,000 are for natural gas.

Transformation of the acquired LPG points has continued, so they can be integrated into the natural gas network. At the end of 2019, nearly 42% of the initially acquired points from Repsol Butano have already been transformed. To those points without conversion, the company distributes and commercialises LPG, and are successfully operated.

The main activity of MRG is the distribution of natural gas, which is a regulated activity. This year has been marked by the regulatory revision for the next regulatory period, starting in January 2021 and finishing at the end of 2026. This revision was started last 5th of July with the issuing, by the CNMC, of a first circular proposal establishing the base for the retribution methodology for the next six years. After a period of allegations, the CNMC has finally approved a circular that includes a continuity retribution methodology with the current parametric formula and an adjustment to the retribution base, according to the activity of the company in 2000. Because MRG did not exist in 2000, the adjustment of the base for MRG is still uncertain and is pending definition by the regulator.

In this regulatory revision context, the rating agencies that evaluate MRG have put in negative observation the credit classification of MRG and its debt, waiting for the resolution of the definite impact for the company for the new regulatory period and for the company to present the corresponding adjustments in its strategy plan corresponding to the mentioned impact for the coming years.

The consortium of company shareholders has not changed during the year. For them, MRG represents a long-term value creation project where they share the same strategic vision and a commitment to long-term financial strength.

| 2018 | 2019 | 1Excluding non-recurring expenses. |

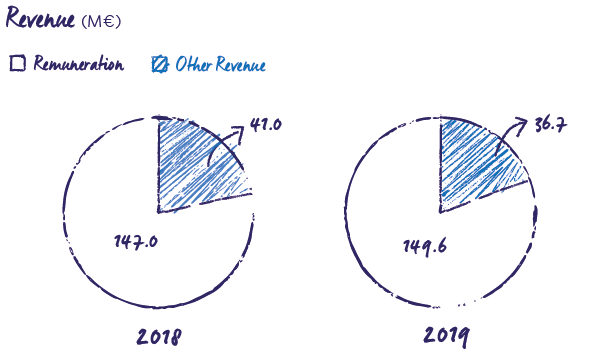

| Remuneration | 147.0 | 149.6 |

| Other revenues | 41.0 | 36.7 |

| EBITDA1 | 141.4 | 145.9 |

| EBIT | 110.6 | 113.7 |

| Net profit | 51.0 | 65.0 |

OPERATING RESULTS

The 2019 EBITDA was 145.9 million Euros This has increased by 3% regarding the EBITDA of 2018. The revenue figures have remained stable. On the other hand, the remuneration for the distribution activity has been higher. This increase of revenue has been compensated by a drop of LPG revenue, because there are less points connected than the previous year, due to the slow conversion of the same being conducted.

The increase in income and less costs due to efficiency in the operations explains the increase of the EBITDA.

REVENUE

The 2019 EBITDA was 186 million Euros. Excluding the income from the LPG activity, the revenue grew by 3% due to greater remuneration and a greater volume of regulated activities.

The LPG revenue agrees with the number of operational connection points that are less than the previous year due to conversion of the same and to the integration into the distribution network of natural gas of the company.

Excluding the revenue of the LPG activity, 86% of the total revenue comes from the legally recognised remuneration for the distribution activity in Order 1367/2018 from the Ministry for Ecologic Transition, published in the Official State Gazette No 308 of 22nd December 2018, and the adjustments that have occurred and estimated of the same according to the evolution of the demand for gas. The remaining 14% refers to other services related to the natural gas distribution activity, like rental of meters, periodical inspections, and other consumer services.

FINANCIAL POSITION AND BALANCE SHEET

Financial strength is an essential pillar in MRG. The company has strong levels of solvency and liquidity consistent with an investment grade rating. The financial structure is efficient and long-term. In year 2018, 500 million Euros were amortised at the date of expiry. In 2019, the gross debt adds up to 950 million Euros with an average period for expiry, at the end of year, of seven years, approximately, and an average cost of 2.7%.

Financial strength is an essential pillar in MRG. In year 2018, 500 million Euros were amortised at the date of expiry

The company has, in addition, a contingent line of credit, which has been reduced to 75 million Euros during the first quarter of 2020, with the objective of achieving efficiency in the financial infrastructure, adjusting the sum of the mentioned line to the real needs of the company for the coming years.

Dividend flexibility is another feature that gives the company a better financial position.

The debt of the group is issued by MRG Finance in the regulated Luxembourg market under the EMTN Programme. This debt is classed as investment grade (BBB) by the Fitch, and Standard and Poor’s rating agencies. During 2019, and after the publication of the first draft of the circular by the CNMC of 5th July 2019, proposing a first draft about the retribution methodology of the gas distribution activity for the 2021-2026 period, the Fitch, Standard and Poor’s rating agencies placed the credit valuation of the company and the debt in negative observation, waiting to know the definite impact of the new regulatory period for the company, and the strategy plan and financial policy the company will follow in the coming years.

After a period of allegations, the CNMC has finally approved, in 2020, a circular that includes a continuity retribution methodology with the current parametric formula and an adjustment to the retribution base, according to the activity of the company in 2000. Because MRG did not exist in 2000, the adjustment of the base for MRG is still uncertain and is pending definition by the regulator.

| 2018 | 2019 | 1In accordance with the International Financial Reporting Standards (IFRS). |

| Gas distribution licences & other intangibles | 748.4 | 751.0 |

| Net tangible fixed assets | 358.5 | 354.9 |

| Total network fixed assets | 1,106.9 | 1,105.8 |

| Goodwill | 57.4 | 57.4 |

| Deferred tax assets | 24.9 | 21.5 |

| Other non-current assets | 1.9 | 55.7 |

| Current assets | 55.8 | 42.3 |

| Cash | 63.0 | 103.4 |

| Total assets | 1,309.9 | 1,386.2 |

| Equity | 233.3 | 298.1 |

| Long term debt | 942.6 | 943.8 |

| Deferred income tax liabilities | 50.2 | 60.1 |

| Other non-current liabilities | 24.1 | 37.5 |

| Current liabilities | 59.7 | 46.7 |

| Total liabilities & shareholders equity | 1,309.9 | 1,386.2 |

CASHFLOW OF OPERATIONS

| 2018 | 2019 | 1In accordance with the International Financial Reporting Standards (IFRS). 2Excluding one-off effects (Deficit monetization 2018 and Project Castor payment received in 2019 plus payment made for previous years Gas balance). |

| EBITDA | 141.4 | 145.9 |

| Income tax paid | (5.9) | (6.9) |

| Working capital2 | (3.9) | (10.5) |

| Capex | (15.1) | (13.5) |

| Free Ccash flow | 116.5 | 114.9 |

The cashflow has been 114.9 million Euros, in line with the previous year. The larger investment in cash flow is due to the end of year position of settlements with the system.

The cash flow calculation does not include non-recurring operational items like the use of the tariff deficit of years 2015 and 2016, in the 2018 figure, and the settlement with Naturgy of the losses corresponding to the years in which the network was not sectorised, to which we add the cash revenue from the enforcement of the judgement about the Castor underground storage during the year 2019.

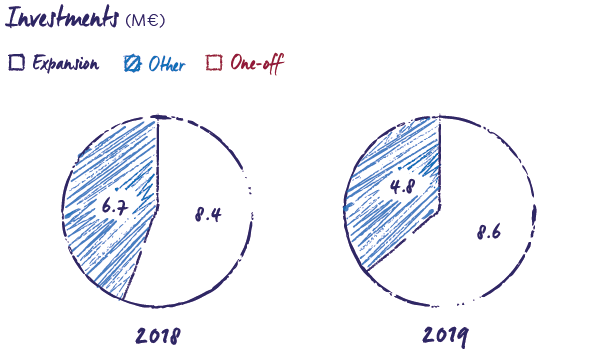

INVESTMENTS

During the year 2019 the investments have reached the figure of 13.5 million Euros. Regarding their purpose, these can be classified into the following groups:

Expansion

During the year 2019 the investments have reached the figure of 13.5 million Euros, of which a total of 8.6 million Euros were for expansion of the network.

MRG has invested a total of 8.6 million Euros in expansion of the network, in line with that invested the previous year and with its viable and sustainable expansion.

Others projects

There are investments in other projects for artificial intelligence tools, digitalisation, processes automation, and development of the information systems that aim to reach targets of cost efficiency and quality improvement in customer service. In this year there has been a reduction of the investment, due to the project initiated in 2016 to fight against fraud, that finished in the year 2019 and has had less provisions in this year than in previous years.